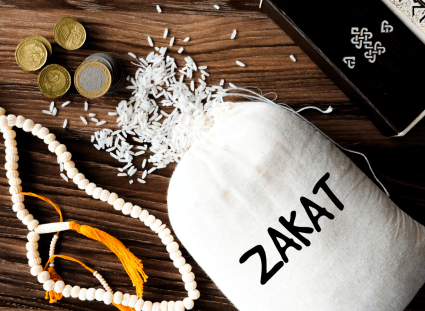

Zakat: The Third Pillar of Islam

Zakat, the third pillar of Islam, is a mandatory act of

worship for all eligible Muslims, signifying their duty to

purify their wealth by helping those in need. It is not merely

a charitable contribution but a compulsory act that embodies

social responsibility and justice.

The term 'Zakat'

itself means 'purification' and 'growth,' indicating that giving

Zakat purifies one's income and wealth from the excessive desire

of materialism and encourages a balanced and just economic system.

Muslims are required to give 2.5% of their accumulated wealth annually

to those eligible to receive it. This wealth includes savings,

investments, gold, silver, and other financial assets that have

been held for a lunar year.

Eligibility and Calculation of Zakat

To be liable to pay Zakat, a Muslim must meet specific conditions. Firstly, they must be of sound mind and reached puberty. The wealth must be above the Nisab threshold, which is the minimum amount of wealth one must have before they are liable to pay Zakat.

The Nisab is calculated based on the current value of 87.48 grams of gold or 612.36 grams of silver.The calculation of Zakat involves assessing all the assets that have been held for one lunar year.These assets include cash, savings, investments, business commodities, and other forms of wealth.

Debts and liabilities can be deducted from this total before calculating the 2.5% that is due. It’s essential to make accurate calculations to ensure the correct amount is given, thus fulfilling one’s religious obligation correctly.

The Beneficiaries of Zakat: Who Should Receive It?

donation

The Qur'an explicitly outlines the categories of individuals who are eligible to receive Zakat in Surah At-Tawbah (9:60). These categories ensure that Zakat reaches those who are genuinely in need and can benefit from it most. The recipients include:

- The Poor (Al-Fuqara'): Those without any means of livelihood and no material possessions.

- The Needy (Al-Masakin): Those who have some income but do not meet their essential needs.

- Zakat Collectors: Individuals appointed by the Islamic authority to collect and distribute Zakat.

By distributing Zakat to these groups, the Muslim community ensures that the wealth is circulated justly and support is given to those in dire need, fostering a sense of unity and brotherhood.

Frequently Asked Questions

When deciding which charity to donate to, it's important to do your search and find one that aligns with your values and interests.